Magna Mining – Q1 2025 Financials, Operations, And Development At The McCreedy West Mine, And Exploration Focused At The Levack Mine

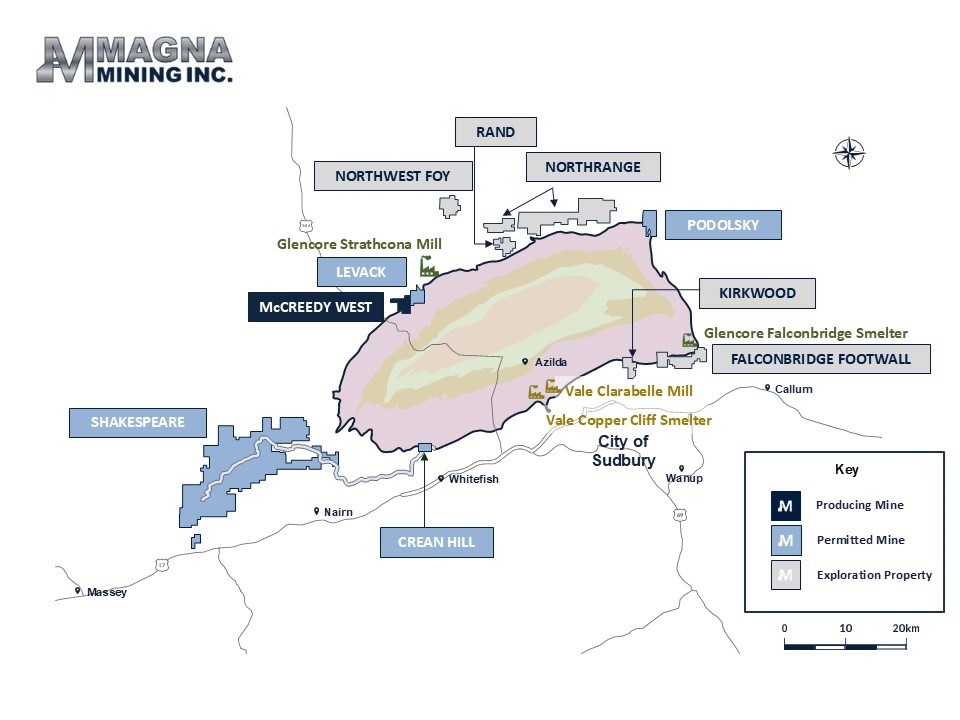

Jason Jessup, CEO and Director of Magna Mining (TSX.V: NICU) (OTCQX: MGMNF), joins me for a review of Q1 financials and operations update at the producing McCreedy West copper mine in Sudbury, Canada. We also review the ongoing exploration and development work at the Levack Mine, working towards and updated resource estimate in Q3 and mine restart plan by year-end. There are currently 4 drill rigs turning between the 2 properties.

We kick off the conversation with a review of Q1 2025 financials and how production and development has been going over the last few months at their McCreedy West Copper Mine, since the company took over the operations from KGHM International on February 28, 2025. The quarter included 1 month of production from McCreedy West coming in at 790,000 lbs of copper equivalent payable in March; and with the total ore processed being 20,388 tonnes at an average grade of 3.01% copper equivalent. The end of Q1 cash balance for the Company was $38.3 million.

Jason discusses the primary focus at McCreedy West for this year is really getting all the development work completed to be able to really ramp up production in a big way in 2026. There will still be ore processed each quarter, but the operations teams wants to get enough stopes opened up through development for the balance of this year to have options in accessing mineralization from different parts of the mine. We also reviewed how in addition to the high-grade copper area of the mine in the 700 Copper Zone, that there is the Intermain Nickel Zone and a Precious Metals Zone, with platinum, palladium, and gold that can be accessed down the road at the right metals prices and margins.

Next we transitioned over to all the exploration focus at the past-producing Levack mine and Jason outlines the Company strategy to keep aggressively drilling and delineating mineralization with a targeted Resource Estimate for Q3, while also continuing with engineering work to then put out a Mine Restart Plan by year end. This is all leading towards the pathway for bringing the Levack Mine back into production in 2026. Additionally, the team is still advancing similar derisking and development work at their Crean Hill Project where, depending on financial market conditions, it could be on a dual track for production in late 2026 or early 2027.

If you have questions for Jason regarding Magna Mining, then please email me at Shad@kereport.com.

- In full disclosure, Shad is a shareholder of Magna Mining at the time of this recording.

Click here to follow along with the news at Magna Mining

.

.

Great update Ex… my top holding and feeling good about it. Might even see $2+ before the EOM. Regular newsflow from here on out with a few surprises. Here’s a question for Jason… has he raised the bar from the $1B MC he original set????…. No worries. We all know the answer. 😉

Thanks Wolfster. Yes, always nice to get a Magna Mining update from Jason.

If they get both Levack and Crean Hill into production, along with drifting in the western areas of McCreedy West by late 2026 early 2027, then a $1B market cap seems doable.

Then if they get Podolsky back into production by late 2027/early 2028, and when they get their plans together for Shakespeare to have it’s own mill, then over a $1.5B – $2.B market cap seems within reach by 2028/2029.

I have been saying for quite a while that Canada is in a “Depression”, this what Bob M is saying about the US.

BM: We’re there. I read an article today where somebody analyzed the actual unemployment rate in the United States, he said this is nonsense talking about whether we’re going into a recession, we’re not in a recession. We’re in a depression and the actual unemployment or under-employment rate is about 24%. Certainly, what Donald Trump has done with the tariffs wants to kick us over the edge into the canyon below.